Page 4 - CAO Overview of the Proposed 2022-23 Budget

P. 4

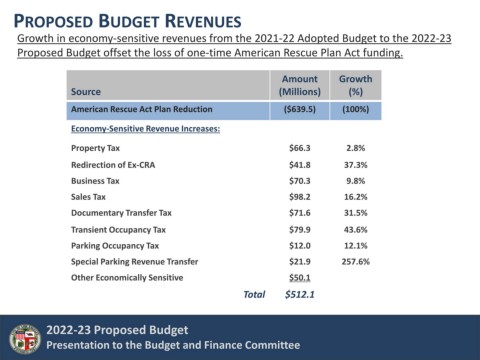

PROPOSED BUDGET REVENUES

Growth in economy-sensitive revenues from the 2021-22 Adopted Budget to the 2022-23

Proposed Budget offset the loss of one-time American Rescue Plan Act funding.

Amount Growth

Source (Millions) (%)

American Rescue Act Plan Reduction ($639.5) (100%)

Economy-Sensitive Revenue Increases:

Property Tax $66.3 2.8%

Redirection of Ex-CRA $41.8 37.3%

Business Tax $70.3 9.8%

Sales Tax $98.2 16.2%

Documentary Transfer Tax $71.6 31.5%

Transient Occupancy Tax $79.9 43.6%

Parking Occupancy Tax $12.0 12.1%

Special Parking Revenue Transfer $21.9 257.6%

Other Economically Sensitive $50.1

Total $512.1

2022-23 Proposed Budget

Presentation to the Budget and Finance Committee